Tourism industry shocked by proposed electricity tariff hike

By Vidhura Ralapanawe, Energy Analyst

Excessive unjustified increases proposed, no change in CEB mentality – is reform process stalled?

Export industries including tourism must be globally competitive and energy pricing should reflect this. The new tariff will crush tourism businesses as they try to work through lack of demand and escalating costs. It could also result in social unrest which may lead to fresh travel warnings.

The extremely high tariff hike proposal is a result of:

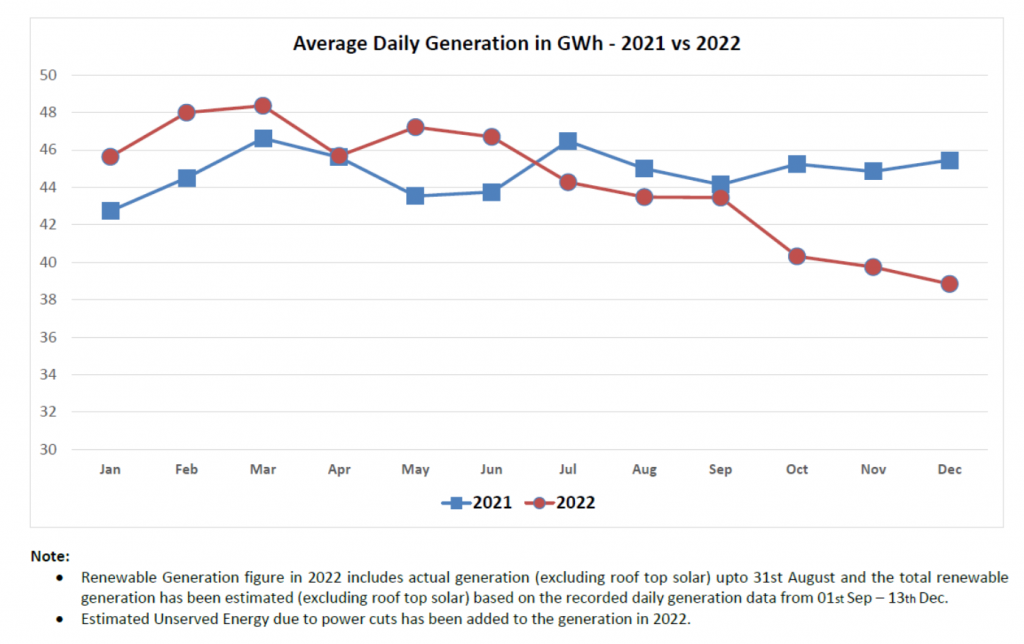

- CEB projecting an artificially high consumption whereas the electricity consumption has contracted from October 2022 when the first tariff increase became operational

- Use of fossil fuel costs at higher than market rates

- Not understanding the principles of tariff setting methodology and trying to apply an average tariff to all consumers. It is also socially unjust, putting the highest burden on low and middle-income households. It will likely force another economic contraction.

A 70% increase on top of the 75% increase in October means tariffs going up by 200% in less than 6 months.

The following is a list of concerns.

- The electricity demand has dropped from October – since the previous tariff hike kicked in, even after accounting for the load shedding. Last quarter of 2022 showed more than 10% decline over the last quarter of 2021. Since CEB tariff calculation is based on data up to September 2021 as per their stated assumptions, this contraction is not shown in CEB demand projections.

- In many countries price elasticity is 0.1 – a 10% drop in consumption when price is doubled. If the proposed increase is approved this will be a 200% increase on pre-August pricing. Thus the proposed pricing will further diminish the demand – and as a result will create an additional economic contraction, lack of competitiveness of exports, tourism and poverty.

- Industrial consumption has fallen by 16% in the last quarter of 2022. With a global and local contraction expected, also with diminished disposable income, there is no possibility to see the demand as high as projected by CEB. PUCSL and others have projected the actual demand to be about 2000 GWh lower than projected by CEB.

- Since the marginal cost of electricity is high (over Rs 90/kWh) this demand reduction would reduce the losses substantially. A 2000 GWh reduction would lead to about Rs 175 Billion reduction of the projected loss at the fuel prices used.

- The fuel prices used for calculations are significantly higher than market rates. Calculations use USD 240/ton for coal – South African coal index is down to USD 188/ton with a projection to reduce to 175/ton by April. Diesel price was used as LKR 430/litre – currently LKR 405/litre. Furnace oil was used as LKR 320 – if imported directly and used, would be about LKR 180/litre including taxes. Naphtha currently LKR 164/litre but market prices are much lower. Adjusting for the likely fuel costs would result in a deep reduction of the proposed budget.

- If these adjustments are made, there will be a minimal increase in the budget, which will spare the population and businesses a lot of economic pain.

- The proposed methodology of allocation of the costs to different consumer groups appear to be deeply misguided and socially inequitable. It does not comply to basic principles of tariff setting including equity (affordability), elasticity and conservation.

- The CEB is working under the premise that all users should be paying the average cost of electricity. Since 4500 GWh is from hydro (less than LKR 3/unit) allocating the same to all customers – each user can consume 100+ units. Since the higher costs are due to high marginal cost, there is no rationale for charging average cost to all users. Higher consuming users should pay more, but that too must allow them to be competitive.

- Low consuming consumers do not have much space for conservation, so high costs would be a penalty forcing them to forego basic needs. The tariff does not look into the affordability of consumers – missing the principle of equity.

- Export industries including tourism must be globally competitive and pricing should reflect the same. This tariff will destroy businesses as they try to work through lack of demand for products and escalating costs.

- The 125% increase in off-peak tariff will dissuade load shifting from evening peak, and will also sound a death knell to heavy industries who operate 24×7 such as fabric mills, rubber and cement, and will divert FDI into this sector to other countries

- CEB demand projection, costing for fuel and power generation, and tariff methodology require expert and public review, which is normally done via PUCSL with the aid of public consultations. The government’s proposal to bypass the PUCSL process as per statute and attempt to impose a tariff through cabinet makes a mockery of independent commissions and eliminates review of costs and optimisation.

One of the fundamental premises of the recent, Cabinet-approved, Power Sector Reform proposal, was ceasing Government subsidy of the sector. This does NOT mean passing the burden of the subsidy to the consumer in the form of a tariff increase. The fact that this increase has been proposed on the basis of bridging CEB’s fiscal deficit (pumped artificially high), may give rise to the following false narratives;

- “They” are raising tariffs to get a better price by “selling” the utility (typically from unions)

- Once the fiscal gap is bridged, is there any real need to reform the sector? (typically from CEB management)

Both the above pose grave existential threats to the reform process, which is essential across many sectors if Sri Lanka is to achieve her full potential, by attempting to manipulate public perception. To say nothing of the fact that it ignores a well-defined statutory tariff revision process, despite obtaining apparent cover from a misused opinion by the Attorney General’s Department, and thus lays itself open to legal action for being ultra-vires.

The other fundamental premises of the PSR proposal were reduced cost of power, increased renewable penetration, equitable setting of tariffs, and an active, commercially self-sustaining energy market. Most consumers would prefer to endure the current limited power cuts (if indeed they are necessary with contracting demand) until these objectives are sustainably met.